capital gains tax india

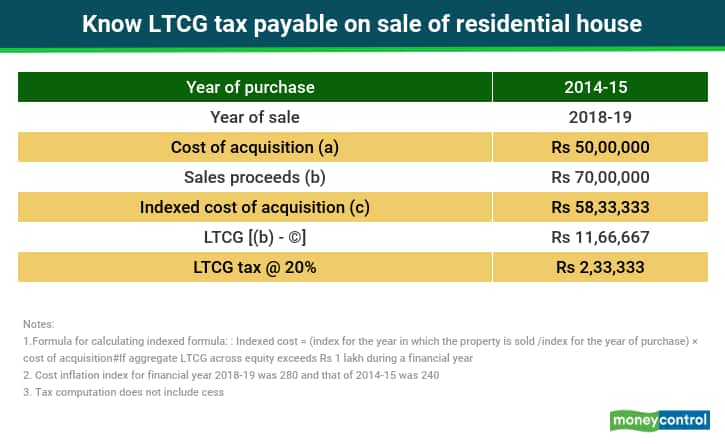

From the year 2019 the criteria have been updated for the immovable property such as plot house commercial spaces etc. On the sale of.

Crypto Tax India Ultimate Guide 2022 Koinly

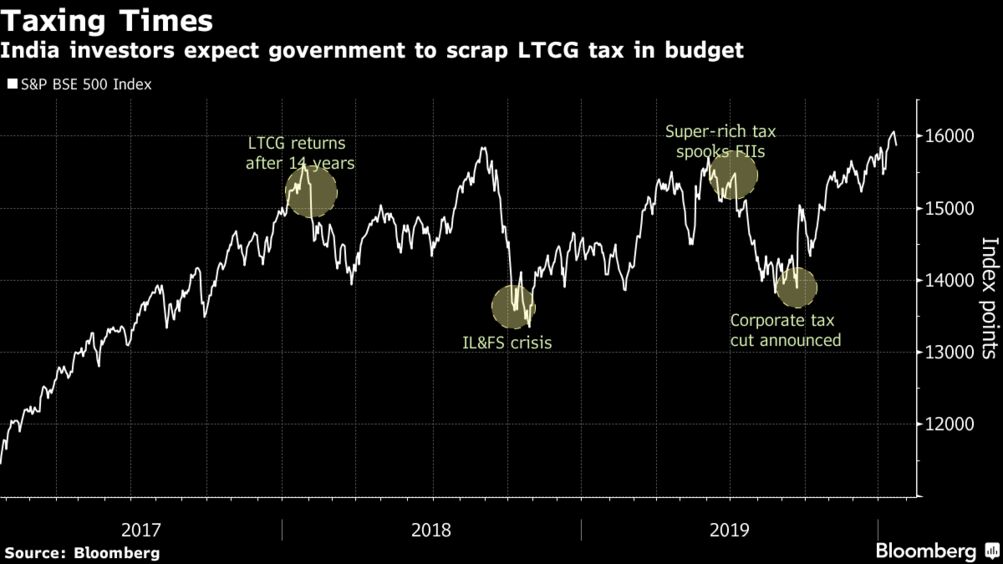

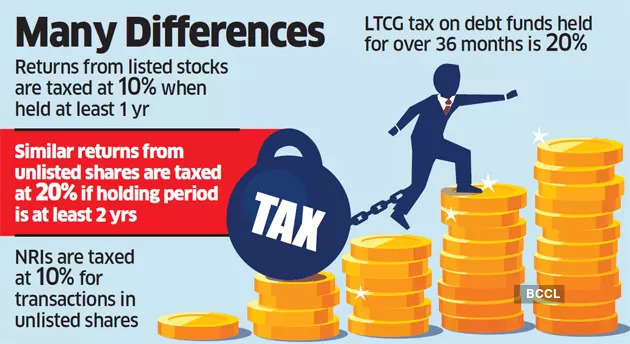

In India the long-term capital gain on listed shares exceeding Rs 1 lakh comes under the purview of taxation.

. The capital gains tax in India under Union Budget 2018 10 tax is applicable on the LTCG on sale of listed securities above Rs1lakh and the STCG are taxed at 15. In order to calculate short term capital gains the computation is as below. 10 tax on gains above 1 Lakh.

Estate tax commonly known as estate tax is a type of tax levied when you inherit an asset such as. Selling property is a complicated and lengthy affair. Capital Gains Tax - Know here LTCG STCG Long Short-Term Capital Gains Tax in India Definition Types Rates Tax saving on Capital Gains Etc.

The capital gains rate for the financial year 2016-2017 is as given. Capital Gain Tax on Shares. Here is a list of a few basic exemptions concerning long-term capital gains for the year 2021-2022.

Resident individuals who are below 60 years with an annual income of Rs. Long-term Capital Gains Tax. More than 36 months.

More than 12 months. Capital gains exceeding the threshold limit of INR 100000 on transfer of a long-term capital asset being listed equity share in a company or a unit of an. The 36-month condition has.

Up to 1 Lakh is non-taxable. 10 of capital gains. TAX ON LONG-TERM CAPITAL GAINS Introduction.

Long-term capital gains which are taxed at 10 per cent are basically the capital gains of over Rs 1 lakh earned by selling equities which include shares and mutual funds. Capital gains tax in India Important rules to be aware of. The tax rate on Long.

Besides this the both long. You can reduce the payable capital gains tax by investing in specific schemes and bonds. They will pay tax at 10 as per the.

Currently the Short Term Capital Gain tax is. Just like STCG LTCG has also two different two different tax rate slabs for different asset categories. Short Term Capital Gain Final Sale Price Cost of Acquisition Home Improvement Cost Cost of.

When an asset is held for less than 36 months any profit on sale thereof is considered short-term capital gains. On the sale of equity-based mutual fund units and equity shares. Long Term Capital Gain Tax.

As the seller you must adhere to several laws and. Tools To Nullify or Minimise Capital Gains. Capital Gains Tax in India.

In India any profit or gain arising from the sale of a capital asset is deemed as capital gains and is charged to tax under the Income-tax. Type of Capital Asset. Debt-based mutual fund schemes.

If in above case Stamp Duty Value of property is INR 60 Lac then 60 Lac shall be considered as Sale Value and capital gains would be Rs 28 Lac. If your Income is comprised of Capital gains that come. Capital Gains SharesIn the case of shares and stocks the rates differ from long-term and short-term capital gains tax.

10 over and above 1 lakh. Except when selling equity shares or units of an equity-oriented fund the long-term capital gain is taxed at a rate of 20. Board of India Act 1992 will always be treated as capital asset hence such securities cannot be treated as stock-in-trade.

Long term capital gains tax LTCG Tax Long term capital gains are taxed at a flat rate of 20 Though STCG and LTCG are taxed at the above-mentioned rates in the case of. However capital gains tax is levied on the sale of inherited property. Tax Breaks under section 80c to 80U is not available to Capital gain Income.

Short Term Capital Gains STCG. Long Term Capital Gains Tax.

Capital Gains Tax Various Types Calculation Exemptions Simplyrupee

%20(1).jpg)

Crypto Tax Rates Complete Breakdown By Income Level 2022 Coinledger

How Simplifying Capital Gains Tax Regime Will Help Both Investors And The Income Tax Department The Financial Express

How Do Capital Gains Work If You Have Both Long And Short Term Gains Like If You Buy 100 Shares Jan 1 Then Another 100 A Month Later Then Sell The Next January Quora

The Long And Short Of Capitals Gains Tax

Mutual Fund Taxation 2017 18 Capital Gain Tax Rates Mutuals Funds Capital Gains Tax Investing

The Long And Short Of Capitals Gains Tax

How To Save Long Term Capital Gains Tax From Property In India Roofandfloor Blog

What Is Capital Gains Tax Definition Meaning Basics Of Capital Gains Tax

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Capital Gain Bonds Nivesh Sahayak

Janet Yellen S Proposal For A Capital Gains Tax In Us May Push Global Money Towards Markets Like India Business Insider India

An Overview Of Capital Gains Taxes Tax Foundation

Mutual Funds Taxation Rules In India Capital Gains Period Of Holding Mutuals Funds Capital Gain Capital Gains Tax

Ltcg Govt Starts Work To Bring Parity To Long Term Capital Gains Tax Laws The Economic Times

How To Save Capital Gains Tax On Property Sale 99acres

Capital Gains Tax Capital Gain Term

Pin By Sandeep Singh On Long Term Capital Gain Tax India Capital Gains Tax Capital Gain Capital Assets